Secrets of Top Distributors: Distribution Revenue Strategies for a Successful Year

Give your team the insights and tools they need to win with a CRM, BI and pricing solution built to integrate with your ERP.

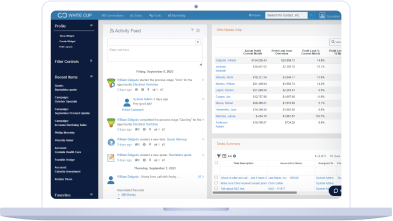

Get a clear picture of business performance, including total sales, top customers and top products, so you can identify areas for growth and improvement. Improve relationships with customers and vendors with distributor CRM software that’s easy for your whole team to use.

White Cup uses AI within our CRM and business intelligence platform to recommend your next best actions that will have the biggest impact on profitability. Discover top related products to recommend for upselling and cross-selling, get notified when customers are likely to re-order, and turn inventory liabilities into sales opportunities.

White Cup’s solutions are configured to deliver what distributors need right out of the box. This accelerates time to value and helps you maintain a competitive edge.

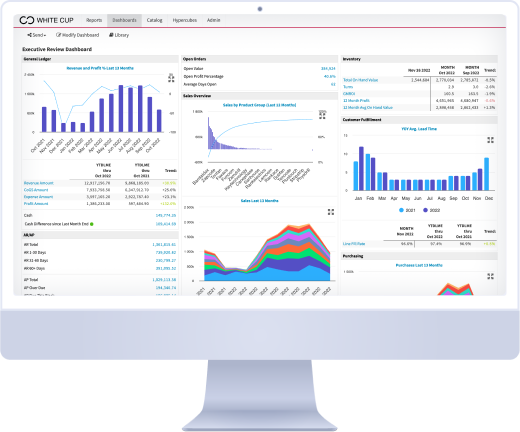

White Cup BI makes ERP, ecommerce, and sales data accessible to everyone in dashboards they can see anytime, anywhere.

With White Cup Pricing, customer or product segmentation and pricing analysis that used to take weeks takes minutes.

“Distribution is such a niche, and White Cup understood our industry. If you want to have a fantastic, out-of-this-world, best customer experience you’ve ever had, White Cup is the way to go."

“It’s a two-way communication between us and our vendors…so when it comes to getting the ROI on the marketing dollars we’re all spending, you have a much clearer picture.”

“We didn’t have to sit down and learn the software then create all the reports. There was a lot we could use right out of the box. It was also a cost-effective decision for us, having flexibility with the number of users.”

"You’ll be hard-pressed to find a reporting software, let alone a trends software, that has such ease of use. It’s a user-friendly way for anybody to access the data they want."

“I love the single-page concept of everything right there on that one page. It has a more modern look and feel to it."

“What’s great about White Cup is that it doesn’t require a large team of analysts to operate, yet it still delivers incredible insights that are crucial to our success."

“The ease of use and the ease of implementation is a significant plus in my world.”

"We're closing deals 75% faster with empowered sales reps, using White Cup CRM and BI."

“White Cup offers powerful products to streamline data analysis and build a distributor’s performance targets into workflows and reports.”

“I would recommend White Cup BI to any Prophet 21 user who currently struggles with data, acquisition and utilization.”

"We increased margins by over 8% using White Cup Pricing."

White Cup’s distribution software solutions integrate with the leading distribution ERPs, to create a seamless onboarding experience. We can integrate with any ERP or data source to give your sales team the data they need to win more deals in real-time.

Before discovering White Cup BI, Callico Distributors had to hire data analysts to produce reports from its ERP system. This cost hundreds of dollars per hour and often took weeks. Now the company makes decisions based on real-time data in White Cup BI. In addition to setting more meaningful sales goals and monitoring KPIs, they’re also using White Cup CRM to create new marketing campaigns and close deals faster.

“We’re going from a totally siloed solution to being able to have visibility between these pillars of the business and plan and react to what’s happening.”

Cole Callahan, Director of Strategic Initiatives, Callico Distributors

Evaluate your sales operations with a distribution expert in a free consultation